23+ How much i can mortgage

Mars was ranked as the sixth-largest privately held company in the United States by Forbes. CBS News Live CBS News Chicago.

Getting A Mortgage Is One Of The Biggest Financial Decisions You Ll Make In 2022 Financial Decisions Financial Advice Finance

The differences can be even greater if you choose a shorter-term loan usually a 10- 15- or 20-year mortgage rather than a 30-year one or if you opt for an adjustable-rate mortgage ARM.

. See Developer Notice on February 2022 changes to XML data feeds. The mortgage should be fully paid off by the end of the full mortgage term. Local News Weather.

Daily Treasury PAR Yield Curve Rates This par yield curve which relates the par yield on a security to its time to maturity is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. Investment property mortgage rates can range from 50 to 875 basis points higher than rates on a primary home. In its first monetary policy announcement of FY 2022-23 the RBI projected inflation to be at 57 this fiscal as compared to 45 in FY22 and GDP growth for FY23 at 72 compared to its earlier projection of 78.

A 100K salary puts you in a good position to buy a home. Reduction of mortgage principal balances by as much as 2030. Bankrate compares thousands of financial institutions to make it easy for you to apply for the best certificate of deposit rate.

Deborah Birx on Face. With an interest only mortgage you are not actually paying off any of the loan. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan.

The 2022 Fidelity Retiree Health Care Cost Estimate found an average 65-year-old couple retiring this year can expect to spend 315000 on health care costs in retirement. Find the best CD rates by comparing national and local rates. The par yields are derived from input market prices.

With a 100000 salary you have a shot at. Should You Refinance Your Mortgage When Interest Rates Rise. 288 289 India is the worlds second largest arms importer.

August 19 2022 1125 AM CBS News. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. As an example if mortgage rates for a 30-year fixed-rate mortgage on an owner-occupied home are averaging about 325 you might expect a 30-year investment property loan to have a 375 to 4125 interest rate.

However fixed-rate mortgages typically have an annual overpayment limit of 10 of your TOTAL outstanding mortgage balance. Capital and interest or interest only. 50 very expensive celebrity divorces.

Like any form of investment theres a lot to consider before you make the. With a capital and interest option you pay off the loan as well as the interest on it. Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages.

A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. Mars Incorporated is an American multinational manufacturer of confectionery pet food and other food products and a provider of animal care services with US40 billion in annual sales in 2020. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments.

Defence expenditure was pegged at US7012 billion for fiscal year 202223 and increased 98 than previous fiscal year. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. What is a Buy to Let mortgage.

What Are the Main Types of Mortgage Lenders. Employers are offering heftier hikes but it still may not be enough to keep up with inflation. 23 of 29.

What Are the Main Types of Mortgage Lenders. By Aly Yale Updated on. Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3.

How much mortgage can you afford based on your salary income and assets. This mortgage finances the entire propertys cost which makes an appealing option. There are two different ways you can repay your mortgage.

Depending on your interest rate taxes PMI costs and other related fees. However as a drawback expect it to come with a much higher interest rate. A Buy to Let property sometimes referred to as buy to rent or BTL is a type of property investment in which the investor becomes a landlord and rents out the property for profit.

The debt increases were 189 trillion in fiscal year 2009 165 trillion in 2010 123 trillion in 2011 and 126 trillion in 2012. How Much Mortgage Can You Afford. It is imperative that low mortgage rates continue until the end of the year says Sandeep Runwal MD Runwal Group.

How large a mortgage payment can you afford today. Mortgage loan basics Basic concepts and legal regulation. Workers expect in 2023.

If youre on your lenders standard variable rate or youre on a tracker mortgage there is normally no limit on how much you can overpay your mortgage by. One of the first questions you ask when you want to buy a home is how much house can I afford. What kind of pay raise can US.

A Buy to Let mortgage is a loan secured against one of these properties. You can take a 100 percent mortgage if youre looking to secure a home loan without making a deposit. If you have this information available you can enter the annual percentage rate APR which includes interest and fees.

Compare and see which option is better for you after interest fees and rates. Between 2016 and 2020 it accounted for 95 of the total global arms imports. Could you still afford an ARM if interest rates rise.

Headquartered in McLean Virginia United States the company is entirely owned by. See the monthly cost on a 250000 mortgage over 15- or 30-years. Guide to hurricane supplies.

Lowering the mortgage balance would help lower monthly payments and also address an estimated 20 million homeowners that may have a financial. The toughest thing to lose in a storm are the things you cant replace like photos and important documents.

1

Pin On Ideas

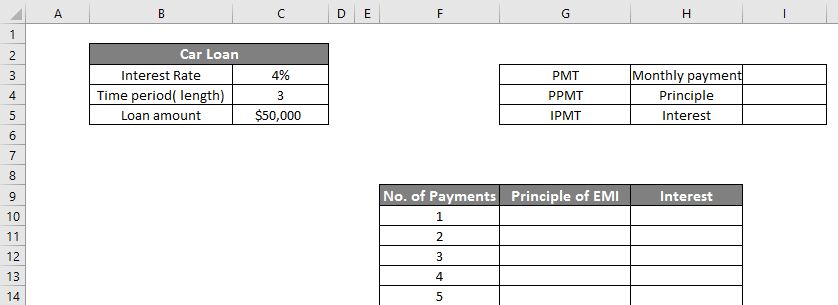

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Swot Analysis Templates 23 Free Printable Word Excel Pdf Examples Samples Formats Swot Analysis Template Swot Analysis Swot Analysis Examples

Pin On Agreement Template

1

Printable Mortgage Budget Planner How To Create A Mortgage Budget Planner Download This Printable Mor Budget Planner Template Budget Planner Budget Planning

1

23 Free Bi Weekly Budget Templates Ms Office Documents Budget Planner Template Weekly Budget Template Budget Template

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Image Result For Thai Fisherman Pants Pattern Thai Fisherman Pants Pants Pattern Free Fisherman Pants

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Buyout Agreement0001 Intervencion Transformacion Social Socialismo

Case Study Bsi Financial

Pin On Agreement Template

1